Exempt and non-exempt are worker categories that determine whether an employee is to be paid overtime. The Fair Labor Standards Act establishes the guidelines for exempt and non-exempt workers. An exempt employee is not entitled to overtime while a non-exempt employee is entitled to overtime, typically at a rate of time and a half above the regular hourly wage.

How does an employer determine a worker’s category? A three-question test, that’s how.

Worker Classification Test

Question One: Is your employee paid a minimum of $35,568 per year?

Question Two: Is your employee paid a consistent salary based on a standard work schedule?

Question Three: Are your employee’s job duties executive, administrative, or professional?

Interpreting the Results

If you answered YES to all three of these questions, then your employee is exempt from earning overtime wages. If you answered NO to even one of these questions, then your employee is classified as non-exempt and overtime pay is required.

Definition of Job Duties

Hang on a minute…. how does an employer know if the employee is performing executive, administrative, or professional duties? Here’s how. Executive duties are defined as having the main responsibility of managing workers and offering feedback that impacts the members of the team. Some examples include hiring, firing, job promotions, etc. A manager at a restaurant, or a supervisor of a retail store are some examples of an executive employee.

Administrative duties are those occupations that work on business support teams, such as being in a role of operations, accounting, or human resources. These duties are those that keep the company up and running.

Professional duties are professions that are learned, usually by attending additional education beyond high school. Examples of this classification would be a doctor, an attorney, or a teacher. Professionals can also have jobs based off of the employee’s talent. Some examples of this would be an actor or musician.

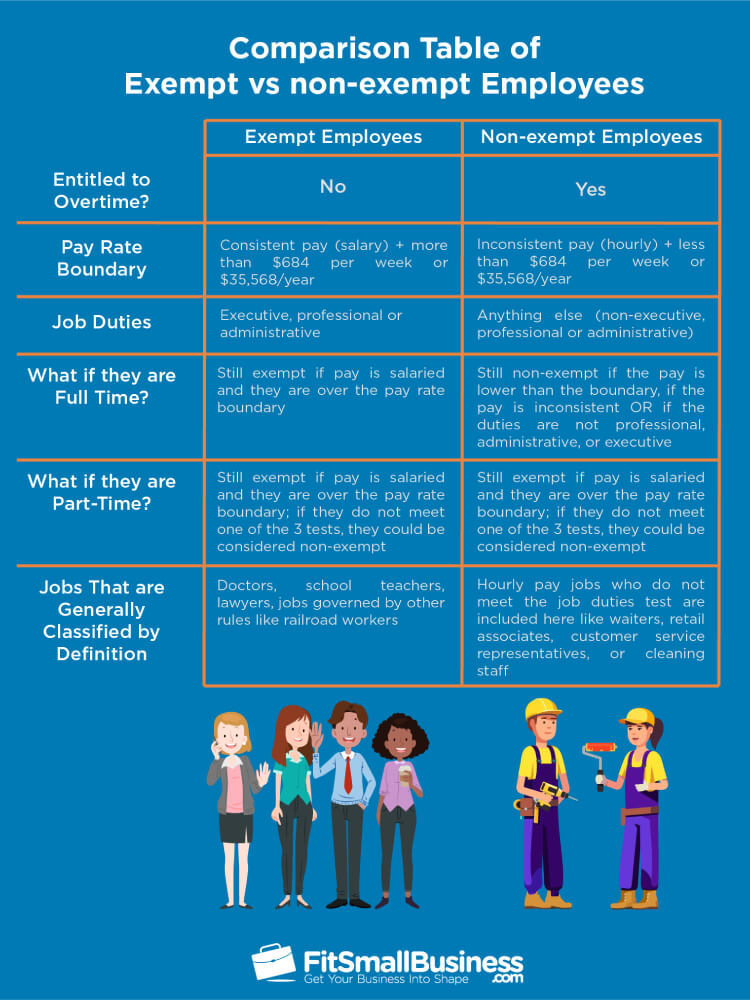

The professionals at Roi Advisers have created this helpful chart to assist employers in correctly determining the category of workers.

What is the big deal? Does it really make a difference as to how your employees are classified? Yes, it does! If an employer does not correctly identify the type of worker the employee belongs in, fines and penalties are possible. Additionally, the employer is responsible for backpay for all extra hours worked for up to three years of all misclassified workers at the overtime rate of pay, time and a half. This can be a very costly mistake that can lead to businesses closing their doors permanently.

If the business owner is still unsure of a worker’s classification, it is best to err on the side of caution, and pay the employee as a non-exempt worker, thus paying for overtime, if applicable. This will eliminate the possibility of back wages being owed to employees as well as additional penalties assessed, not to mention, an ease of mind for the employer.